The Smart City Infrastructure Fund is an investment vehicle which provides long-term private institutional capital for the development of sustainable urban ecosystems. The Fund helps cities deal with:

- Continued urbanization

- Climate change and resource scarcity

- Development of sustainable communities

- Technological advancement and digitalisation

- Energy and Resources Efficiency

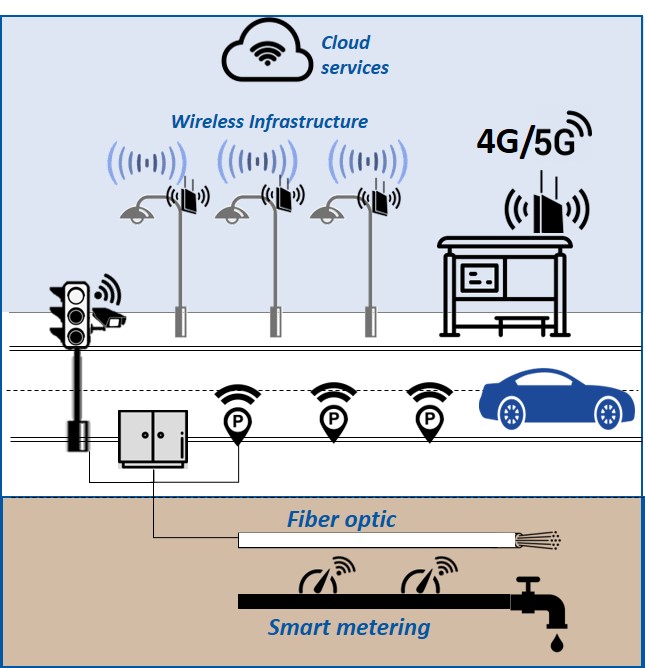

- Public Street lighting: Retrofitting LED lights and smart dimming sensors allows for 50-75% savings in energy usage (See more – Selettra (Italy) and Ottima (Italy))

- Smart Meters -> Case Study: Allows for effective control of energy usage, leading to increased savings and cleaner energy use

- Networks and Grids

- Fiber Optic Networks (FON): City-wide FON provides the necessary connectivity and backhaul capacity to develop Smart Cities, IoT and 5G (See more – Fullerton Fibercity investment)

- Wireless Infrastructure: LoRa / WAN networks provide connectivity to Smart City sensors

- Mobility

- Smart Traffic Lights:Sensors at intersections monitor and manage traffic, handle incidents more efficiently, reduce congestion and improve livability

- Smart Parking: Parking sensors reduce circling and congestion, improve revenue collection and improve enforcement

- Data Analytics

- Smart Safety and Security: Automatically detect security incidents, shorten response time, and analyse data to reduce crime

- Social Infrastructure: Smart Waste Management, Smart Kiosks, Air Pollution Analytics, Smart Location Services

| Investment size: | > €10 million |

|---|---|

| Investment term: | 10-year minimum |

| Geography: | OECD countries worldwide |

| Structure: | Public private partnerships (PPP / P3), concessions, sale & lease-back |

| Eligible Funding: | Common equity in individual assets, preferred equity and acquisition of receivables |

| Stage: | Operating assets or ready to build assets |

- Long-term partnership between City & Long term institutional investors, focusing on outcomes, citizen engagement and inclusive and cohesive societies

- SCIF investment can be blended with grant and other forms of public funding

- Open access model avoid multiple build-outs and unnecessary construction works

- Ability to achieve financial savings from day one via flexible smart concessions (e.g. Public Smart Street lighting) (See More – Investments InNovalux)

- Expert institutional investor with over 21 years’ of experience investing globally in infrastructure (See more – Investors)

- Proven record of Smart City investing (See more – Investments)

- SCIF is a member of a number of the organisations at the forefront of responsible and sustainable investing (See more – Investments)